• Voters Will Decide Fate of $1.2 Billion/Year for Highways

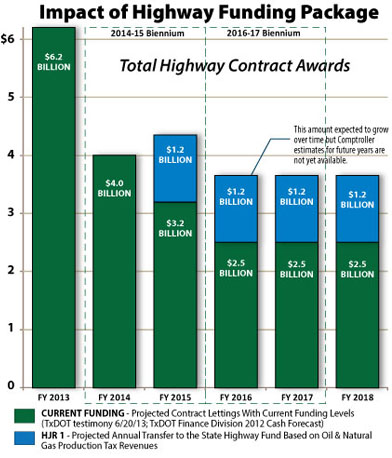

With a major push from community leaders statewide and a wide array of transportation advocates, the Texas Legislature ended a third special session in August with passage of a measure estimated to increase transportation funding by $1.2 billion annually if Texas voters approve it next year. And that yearly number is likely to increase in future years.

That amount, if approved, will provide about a quarter of the projected highway funding shortfall that faces Texas. Additional incremental funding will need to be pursued when the Legislature meets in 2015.

Lawmakers spent a good deal of time during the seven months they were in session talking about the need to address the impending major highway funding cliff. During the regular session, however, they only allocated an additional $850 million in one-time funding against a growing gap of more than $5 billion a year. Little progress was made on providing a new permanent, reliable and growing funding stream for investment in Texas highways.

At the beginning of the three special sessions Senator Robert Nichols, chairman of the Senate Transportation Committee, stepped forward with the idea of capturing oil and natural gas production taxes before they go into the Economic Stabilization Fund (rainy day fund). Rep. Joe Pickett picked up the idea in the House. A compromise proposal was ultimately adopted by a vote of 22 to 3 in the Senate and 106 to 21 in the House.

The Alliance for I-69 Texas and other statewide organizations came together in the final days before the vote to offer lawmakers their full support in voting for the measure. Passage of the Amendment will result in projects being put in motion that would otherwise be deferred as Texas falls further behind.

NOVEMBER 2014 ELECTION - When voters go to the polls in the statewide General Election in November 2014 they will be asked to vote for or against the following: "The constitutional amendment providing for the use and dedication of certain money transferred to the state highway fund to assist in the completion of transportation construction, maintenance, and rehabilitation projects, not to include toll roads."

The amendment asks voter permission to take half the taxes on oil and natural gas production that now go to the Economic Stabilization Fund and place the amount in the State Highway Fund. Oil production in Texas is growing dramatically and huge natural gas fields have been discovered and will be developed in the years ahead as natural gas demand grows and prices improve. The passage of the Amendment will mean more funding for highways and strong revenues continuing to flow to the Economic Stabilization Fund.

SELECT COMMITTEE - Lawmakers passed HB 1, the companion enabling legislation, which creates special House and Senate study committees that can meet jointly and will write a single report for the 2015 Legislature on ways to finance highways needs in the long term. This provides an opportunity to keep the spotlight on transportation funding during the interim. Their report is due Nov. 1, 2014, just before the constitutional amendment election. The report should provide the next Legislature with a clear, updated look at highway under funding and possibilities for bridging that gap. It will look at the future reliability of all current TxDOT funding sources. It will also look at debt financing which has been the state’s default method for the past decade. It will present revenue ideas used by other states and other nations. The objective is to help the 2015 Legislature find a sustainable way of paying the cost of modern transportation.

The Legislature approved more than a dozen other transportation bills. The two-year Appropriations Bill provides the Texas Department of Transportation with $200 million each year from the state fuels tax that was previously diverted to the Department of Public Safety.

Bills aimed at generating new revenue to fund transportation were either withdrawn or never made it out of the appropriations committee. Many made it clear they opposed taking votes on increases in fees or fuel taxes. There appeared to be substantial support for shifting some existing revenue from vehicle sales taxes from General Revenue to the State Highway Fund but in the end this proposal was sidetracked.

A proposal to add $30 a year to the vehicle registration fee made it to the House floor but was pulled down before a vote was taken. There were several vehicle registration fee increase bills introduced with the intent of raising new dedicated revenue for highways.

TxDOT has had a robust construction program in recent years fed by what will be almost $18 billion in borrowing by 2015. The Legislature, along with citizens in a couple of constitutional amendment votes, authorized bond sales that produced increases in TxDOT spending on roads beginning in 2004. The largest of those spikes — $9 billion in 2013 — was taking place as legislators were being told more money is needed. There were numerous mentions of “orange barrel fatigue” during the session.

Starting in the 2014-15 fiscal year, TxDOT will have less than $3 billion a year for roads, and a large percentage of that will go to maintaining existing roads rather than building new ones. One result is that highway construction companies across the state are reducing staff and preparing in hopes of surviving the coming drought of new projects.

The state budget also provides a one-time $450 million appropriation specifically directed at hundreds of miles of damaged rural roads in the South Texas Eagle Ford Shale and Permian Basin oil and gas fields. TxDOT has indicated that it would require more than $1 billion each year just to deal with the damage being done to state highways and farm-to-market roads by thousands of oilfields trucks servicing the booming oil patch.

Other transportation legislation related to I-69 and the counties along the I-69 route includes:

SB 1730 by Sen. Nichols continues comprehensive development agreement authorization for TxDOT and for regional mobility authorities. The law adds non-tolled highway projects and reconstruction projects to the list of eligible CDA projects including nine in the Dallas-Fort Worth area and five in the Rio Grande Valley. The full list includes projects that are I-69 connectors including SH 99 (Grand Parkway), SH 288 south to SH 6, the Cameron County Outer Parkway, South Padre Island 2nd Causeway, Hidalgo County Loop and International Bridge Trade Corridor.

SB 1110 by Nichols now allows creation of a multi-county transportation reinvestment zone. It allows local governments to spend money on projects outside their jurisdiction if the projects would benefit that local city or county.

HB 1198 by Rep. Richard Raymond authorizes Webb County (Laredo) to approve an optional $10 county fee for vehicles registered in the county. Legislation requires that the funds flow through to a local regional mobility authority. The new fee will generate approximately $1.6 million per year in Webb County. This approach was approved in earlier sessions for Hidalgo and Cameron counties in the Rio Grande Valley.

SB 1747 by Sen. Carlos Uresti establishes a fund for certain county transportation infrastructure projects intended to alleviate degradation caused by oil patch activity. It authorizes counties to designate a maximum of one county Energy Transportation Reinvestment Zone and allows a county to pledge property tax and sales tax increments to a specific transportation project. It establishes a grant program to be administered by TxDOT and sets criteria for distribution (60 percent based on well completions in previous year, 20 percent based on weight of tolerance permits, and 20 percent based on oil and gas production taxes).

.JPG)